tax break refund date

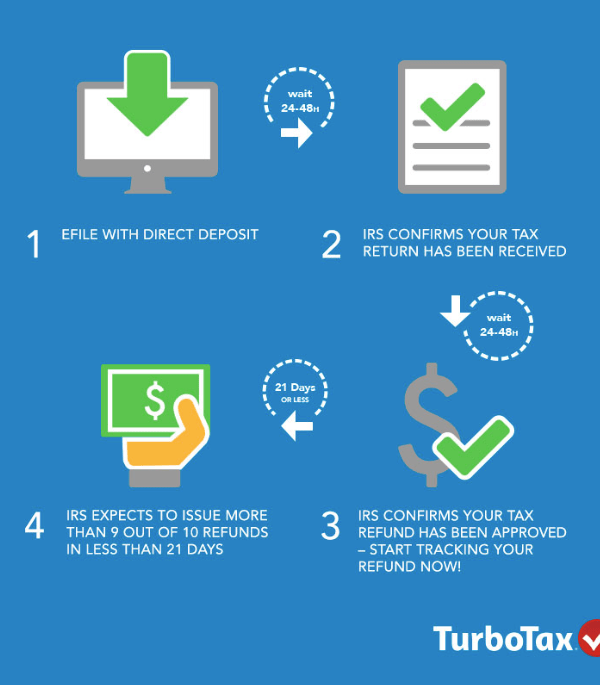

However some taxpayers may see their refunds a few days earlier. Typically taxpayers who file their returns electronically can expect to receive their tax refund within three weeks or 21 days.

How Are Tax Refunds Affected In A Bankruptcy Bankruptcy Canada

The IRS announced earlier this month that the agency had begun the process of adjusting tax returns for those who had claimed unemployment benefits in 2020.

. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Using a Mobile Device. Refund for unemployment tax break.

Blake Burman on unemployment fraud. Payments started going out to those taxpayers and the agency will continue to send payments weekly through the summer. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020.

Brian Kemp says special state income tax refunds will begin this week although it could be early August before everyone who filed a return before the April deadline will get paid. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it you could be waiting a total of 26. The IRS has sent 87 million unemployment compensation refunds so far.

Wheres My Refund tells you to contact the IRS. Check For The Latest Updates And Resources Throughout The Tax Season. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020. 1 the IRS has now issued more than 117 million unemployment compensation refunds totaling over 144 billion. 21 days or more since you e-filed.

Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. 6 weeks or more since you mailed your return or when. Although some states add state taxes to the benefits Minnesota issued a tax exemption just as the federal government did.

IRS schedule for unemployment tax refunds With the latest batch of payments on Nov. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Those who choose direct deposit can receive their refunds even.

If its been longer find out why your refund may be delayed or may not be the amount you expected. This is the latest round of refunds related to the added tax exemption for the first 10200 of. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break.

Finally workers must report March tips to their employer by April 11 estimated taxes for the 1st quarter of 2022 are due April 18 and April 18 is the last day to claim a tax refund for the 2018. The date you get your tax refund also depends on how you filed your return. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

What You Will Need Social security number or ITIN Your filing status. The unemployment tax break is a special type of refund that allows you to deduct up to 20400 of unemployment benefits from your earnings. So in theory if you e-file your tax return on the starting day of January 27 th 2022 you should receive your tax refund by February 16 th or a paper check between March 9th and March 23rd.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The 19 trillion coronavirus. For example with refunds going into your bank account via direct deposit it could take an additional five days for your bank to post the money to your account.

The IRS tax refund schedule dates according to the IRS are 21 days for e-filed tax returns and 6 to 8 weeks for paper returns. May 12 2022 734 AM 3 min read. In total over 117 million refunds have been issued totaling 144 billion.

Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. May 7th 2021 0821 EDT. This caused millions of taxpayers to file tax returns paying the taxes due by that date.

Learn How Long It Could Take Your 2021 Tax Refund. Download the IRS2Go app to check your refund status. Ad See How Long It Could Take Your 2021 Tax Refund.

You should only call if it has been. So in theory if you e-file your tax return on the starting day of January 27 th 2022 you should receive your tax refund by February 16 th or a paper check between March 9th and March 23rd. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. The IRS expects most EITCAdditional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1 if they chose direct deposit and there are no other issues with their tax return. The IRS issues most refunds in less than 21 days although some require additional time.

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

How To File Income Tax Return To Get Refund In Canada 2022

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

How To File Income Tax Return To Get Refund In Canada 2022

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

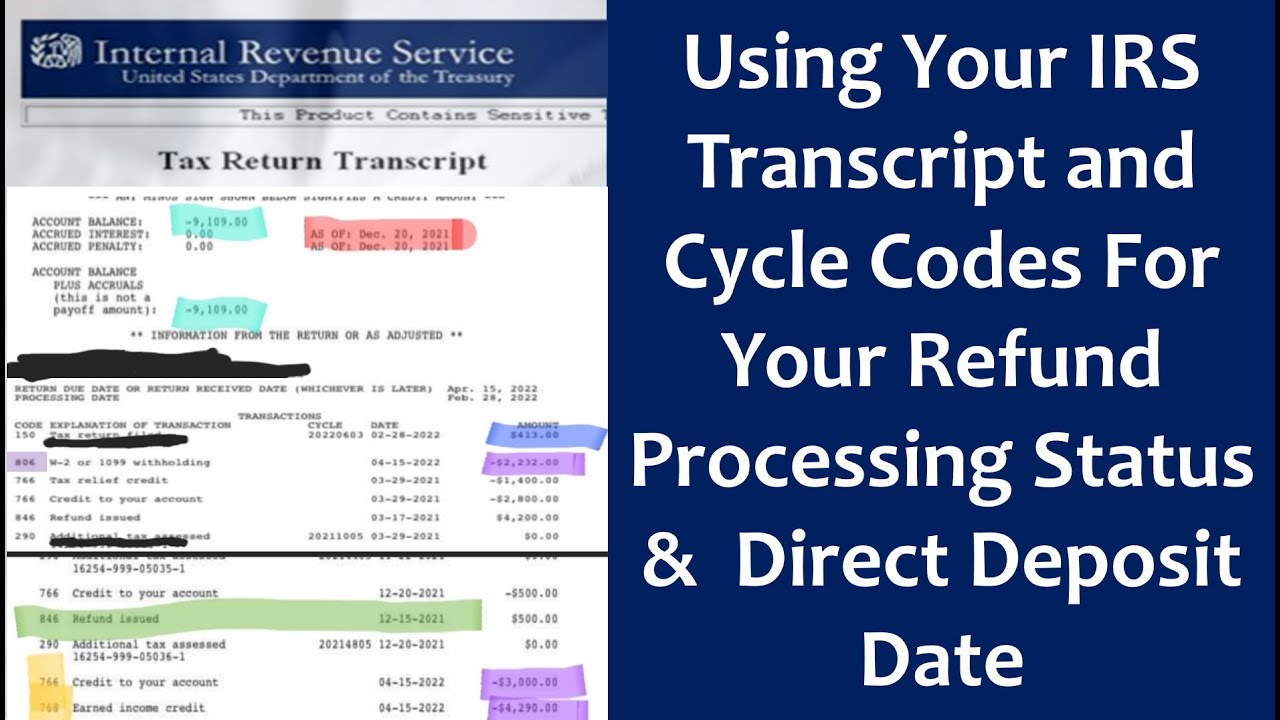

Using Your Irs Transcript Tax Cycle Codes For Your Refund Processing Status Direct Deposit Date Youtube

If As Of Date On Transcript Is Based On Something The Irs Did In The Past Why Do I Have An As Of Date That S In The Future 3 15 2021 R Irs

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)